Complete Guide

Automate and grow your practise

Ultimate AI Resource For Financial Advisors

Resources for financial advisors, RIAs, wealth managers, and planners who want to understand how modern AI tools can simplify their workflows. Think of this page as both a resource hub and a roadmap for using AI to future-proof your practice.

Resources for financial advisors, RIAs, wealth managers, and planners who want to understand how modern AI tools can simplify their workflows. Think of this page as both a resource hub and a roadmap for using AI to future-proof your practice.

Explore by categories

Discover how AI is transforming financial advisory. Explores AI-driven strategies for client acquisition, portfolio management, personalized communication, and firm growth.

AI in Client Communication & Notetaking

AI Note-Taking for Financial Advisors: From Meeting Chaos to Clean CRM

Advisors lose 10–11 hours a week to note-taking, follow-ups, and manual CRM updates. This article lays out a better way: AI-powered meeting capture with auto-summaries, tasks, and compliant logs pushed directly into your CRM. It compares generic tools to advisor-specific platforms, provides a pilot plan, and shows how to measure time saved and client impact. Beyond efficiency, it reframes AI as a path to being more present, with less transcription and more listening. If your team’s post-meeting process is inconsistent, this is the playbook to fix it.

AI Note-Taking for Financial Advisors: From Meeting Chaos to Clean CRM

Advisors lose 10–11 hours a week to note-taking, follow-ups, and manual CRM updates. This article lays out a better way: AI-powered meeting capture with auto-summaries, tasks, and compliant logs pushed directly into your CRM. It compares generic tools to advisor-specific platforms, provides a pilot plan, and shows how to measure time saved and client impact. Beyond efficiency, it reframes AI as a path to being more present, with less transcription and more listening. If your team’s post-meeting process is inconsistent, this is the playbook to fix it.

AI Note-Taking for Financial Advisors: From Meeting Chaos to Clean CRM

Advisors lose 10–11 hours a week to note-taking, follow-ups, and manual CRM updates. This article lays out a better way: AI-powered meeting capture with auto-summaries, tasks, and compliant logs pushed directly into your CRM. It compares generic tools to advisor-specific platforms, provides a pilot plan, and shows how to measure time saved and client impact. Beyond efficiency, it reframes AI as a path to being more present, with less transcription and more listening. If your team’s post-meeting process is inconsistent, this is the playbook to fix it.

Automating Content and Communitcation For Financial Advisors

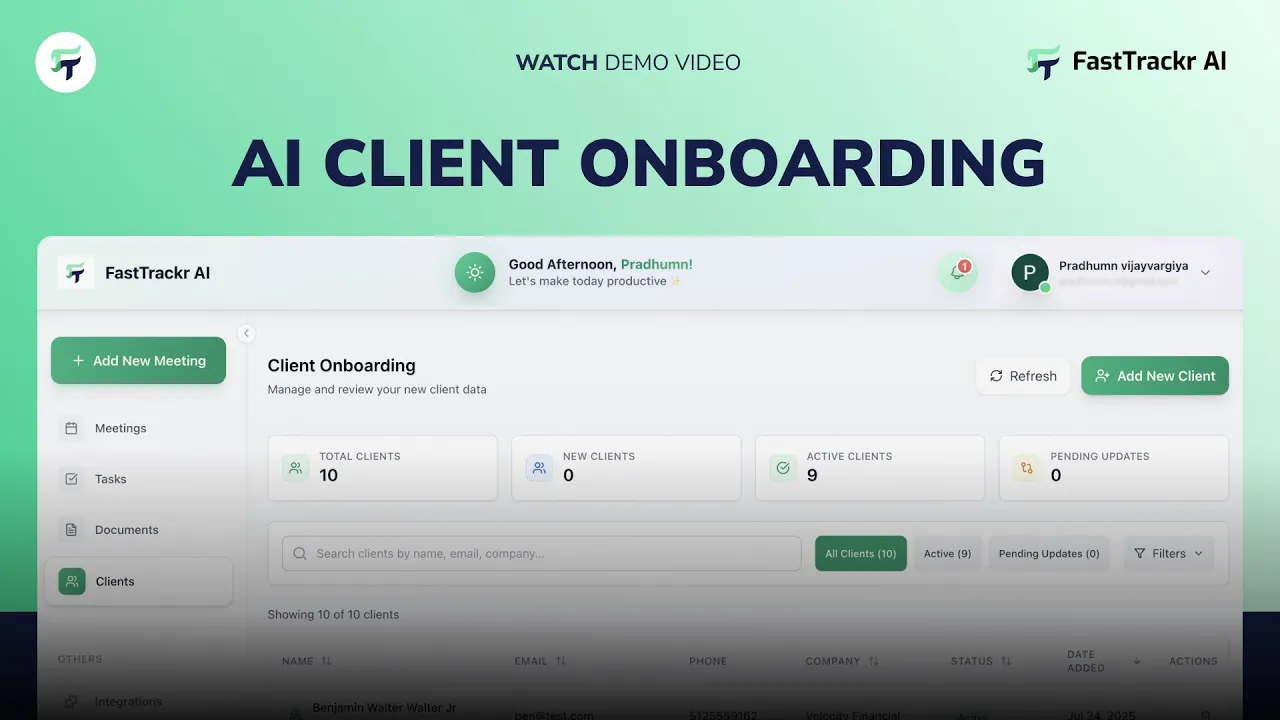

One of the most common challenges for advisory firms is figuring out how to scale the service experience without compromising the personal attention that built the business in the first place. Historically, this has been managed through hiring additional support staff, associate advisors, paraplanners, operations managers, and so on. But human capital is expensive, onboarding is time-consuming, and service delivery can become inconsistent if everyone isn't working from the same systems.

Automating Content and Communitcation For Financial Advisors

One of the most common challenges for advisory firms is figuring out how to scale the service experience without compromising the personal attention that built the business in the first place. Historically, this has been managed through hiring additional support staff, associate advisors, paraplanners, operations managers, and so on. But human capital is expensive, onboarding is time-consuming, and service delivery can become inconsistent if everyone isn't working from the same systems.

Automating Content and Communitcation For Financial Advisors

One of the most common challenges for advisory firms is figuring out how to scale the service experience without compromising the personal attention that built the business in the first place. Historically, this has been managed through hiring additional support staff, associate advisors, paraplanners, operations managers, and so on. But human capital is expensive, onboarding is time-consuming, and service delivery can become inconsistent if everyone isn't working from the same systems.

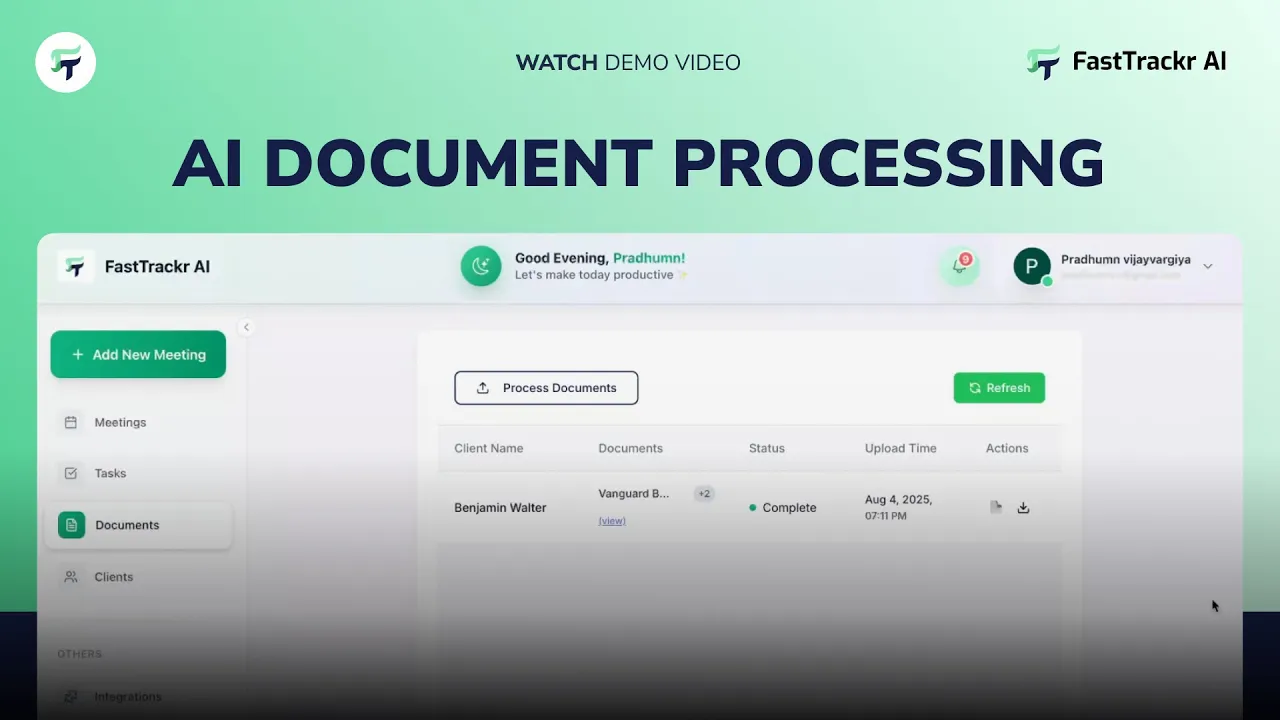

Document Processing & Back-Office Automation

How Back-Office Automation Is Transforming Financial Advisory Firms

Advisory firms spend staggering time on non-revenue tasks, compliance, billing, reconciliation, document management. This deep dive quantifies the cost and lays out where automation pays off first: onboarding (OCR + APIs to prefill systems), compliance monitoring, and dynamic billing. You’ll see how AI + workflow automation reduce errors, compress cycle times, and create operating leverage so revenue can scale faster than headcount. Perfect for COOs and founders who want clear ROI narratives and a prioritization map for 90-day wins.

How Back-Office Automation Is Transforming Financial Advisory Firms

Advisory firms spend staggering time on non-revenue tasks, compliance, billing, reconciliation, document management. This deep dive quantifies the cost and lays out where automation pays off first: onboarding (OCR + APIs to prefill systems), compliance monitoring, and dynamic billing. You’ll see how AI + workflow automation reduce errors, compress cycle times, and create operating leverage so revenue can scale faster than headcount. Perfect for COOs and founders who want clear ROI narratives and a prioritization map for 90-day wins.

How Back-Office Automation Is Transforming Financial Advisory Firms

Advisory firms spend staggering time on non-revenue tasks, compliance, billing, reconciliation, document management. This deep dive quantifies the cost and lays out where automation pays off first: onboarding (OCR + APIs to prefill systems), compliance monitoring, and dynamic billing. You’ll see how AI + workflow automation reduce errors, compress cycle times, and create operating leverage so revenue can scale faster than headcount. Perfect for COOs and founders who want clear ROI narratives and a prioritization map for 90-day wins.

How AI Document Processing is Transforming Wealth Management

Every relationship begins with documents, brokerage statements, trust paperwork, tax files. This article shows how AI turns unstructured PDFs and scans into structured, accurate data in minutes. Core use cases include multi-custodian aggregation, holdings extraction, proposal autofill, and export to planning tools. You’ll see the compliance upside (auditability, consistency) along with downstream benefits: faster onboarding, stronger reviews, and a clearer household view for advisors. If you’re still manually keying data across systems, this is the business case, and the workflow to stop.

How AI Document Processing is Transforming Wealth Management

Every relationship begins with documents, brokerage statements, trust paperwork, tax files. This article shows how AI turns unstructured PDFs and scans into structured, accurate data in minutes. Core use cases include multi-custodian aggregation, holdings extraction, proposal autofill, and export to planning tools. You’ll see the compliance upside (auditability, consistency) along with downstream benefits: faster onboarding, stronger reviews, and a clearer household view for advisors. If you’re still manually keying data across systems, this is the business case, and the workflow to stop.

How AI Document Processing is Transforming Wealth Management

Every relationship begins with documents, brokerage statements, trust paperwork, tax files. This article shows how AI turns unstructured PDFs and scans into structured, accurate data in minutes. Core use cases include multi-custodian aggregation, holdings extraction, proposal autofill, and export to planning tools. You’ll see the compliance upside (auditability, consistency) along with downstream benefits: faster onboarding, stronger reviews, and a clearer household view for advisors. If you’re still manually keying data across systems, this is the business case, and the workflow to stop.

How Financial Advisors Are Using AI for Document Processing

This practical guide outlines how RIAs deploy AI for extraction, intelligent categorization, enrichment, and client-ready report generation—across statements from Schwab, Fidelity, Vanguard, and more. It covers implementation (templates, training data, audit trails), performance expectations, and where to integrate with CRM and planning software. The result is a durable process that slashes manual entry, strengthens compliance, and frees teams to focus on planning and client relationships. If you’re building a document AI program, this is your checklist for capabilities and rollout.

How Financial Advisors Are Using AI for Document Processing

This practical guide outlines how RIAs deploy AI for extraction, intelligent categorization, enrichment, and client-ready report generation—across statements from Schwab, Fidelity, Vanguard, and more. It covers implementation (templates, training data, audit trails), performance expectations, and where to integrate with CRM and planning software. The result is a durable process that slashes manual entry, strengthens compliance, and frees teams to focus on planning and client relationships. If you’re building a document AI program, this is your checklist for capabilities and rollout.

How Financial Advisors Are Using AI for Document Processing

This practical guide outlines how RIAs deploy AI for extraction, intelligent categorization, enrichment, and client-ready report generation—across statements from Schwab, Fidelity, Vanguard, and more. It covers implementation (templates, training data, audit trails), performance expectations, and where to integrate with CRM and planning software. The result is a durable process that slashes manual entry, strengthens compliance, and frees teams to focus on planning and client relationships. If you’re building a document AI program, this is your checklist for capabilities and rollout.

AI for Client Prospecting & Growth

Marketing & Client Prospecting Using AI: A Blueprint for Scalable Growth

Stop guessing and start targeting. This playbook shows how to use real-time signals (job changes, liquidity events), predictive lead scoring, and automated yet personal outreach to attract ideal clients. It maps integrations across LinkedIn, CRM, and FastTrackr AI to trigger timely messages that feel human, not spammy. You’ll get a KPI view (first touch → meeting → client) and guidance on building dashboards that optimize channel ROI. If your growth engine leans too heavily on referrals or seminars, this article gives you a modern, data-driven system that compounds every quarter.

Marketing & Client Prospecting Using AI: A Blueprint for Scalable Growth

Stop guessing and start targeting. This playbook shows how to use real-time signals (job changes, liquidity events), predictive lead scoring, and automated yet personal outreach to attract ideal clients. It maps integrations across LinkedIn, CRM, and FastTrackr AI to trigger timely messages that feel human, not spammy. You’ll get a KPI view (first touch → meeting → client) and guidance on building dashboards that optimize channel ROI. If your growth engine leans too heavily on referrals or seminars, this article gives you a modern, data-driven system that compounds every quarter.

Marketing & Client Prospecting Using AI: A Blueprint for Scalable Growth

Stop guessing and start targeting. This playbook shows how to use real-time signals (job changes, liquidity events), predictive lead scoring, and automated yet personal outreach to attract ideal clients. It maps integrations across LinkedIn, CRM, and FastTrackr AI to trigger timely messages that feel human, not spammy. You’ll get a KPI view (first touch → meeting → client) and guidance on building dashboards that optimize channel ROI. If your growth engine leans too heavily on referrals or seminars, this article gives you a modern, data-driven system that compounds every quarter.

AI Powered Client Acquisition For RIAs

The reality of advisor technology adoption has always been... complicated. We're an industry that still debates the merits of email versus phone calls for client communication, yet we're simultaneously being told that artificial intelligence will revolutionize everything we do. But here's the thing: while most of the AI hype in our industry is just that - hype - there are genuine, practical applications emerging that can meaningfully impact how we acquire and onboard new clients. The key is separating the signal from the noise. The traditional client acquisition playbook for RIAs has remained remarkably unchanged for decades. Cold outreach (mostly ineffective), referral networking (feast or famine), and hours upon hours of manual preparation for each prospect interaction. It's a system that worked when our industry was smaller, when prospects had fewer options, and when "good enough" client service could differentiate you from the wirehouses.

AI Powered Client Acquisition For RIAs

The reality of advisor technology adoption has always been... complicated. We're an industry that still debates the merits of email versus phone calls for client communication, yet we're simultaneously being told that artificial intelligence will revolutionize everything we do. But here's the thing: while most of the AI hype in our industry is just that - hype - there are genuine, practical applications emerging that can meaningfully impact how we acquire and onboard new clients. The key is separating the signal from the noise. The traditional client acquisition playbook for RIAs has remained remarkably unchanged for decades. Cold outreach (mostly ineffective), referral networking (feast or famine), and hours upon hours of manual preparation for each prospect interaction. It's a system that worked when our industry was smaller, when prospects had fewer options, and when "good enough" client service could differentiate you from the wirehouses.

AI Powered Client Acquisition For RIAs

The reality of advisor technology adoption has always been... complicated. We're an industry that still debates the merits of email versus phone calls for client communication, yet we're simultaneously being told that artificial intelligence will revolutionize everything we do. But here's the thing: while most of the AI hype in our industry is just that - hype - there are genuine, practical applications emerging that can meaningfully impact how we acquire and onboard new clients. The key is separating the signal from the noise. The traditional client acquisition playbook for RIAs has remained remarkably unchanged for decades. Cold outreach (mostly ineffective), referral networking (feast or famine), and hours upon hours of manual preparation for each prospect interaction. It's a system that worked when our industry was smaller, when prospects had fewer options, and when "good enough" client service could differentiate you from the wirehouses.

Using Agentic AI to Reclaim Time and Transform Client Relationships

The financial advisory industry stands at a fascinating crossroads. While client expectations for personalized service continue to rise, advisors find themselves drowning in administrative tasks, document processing, and repetitive workflows that consume precious hours better spent on relationship building and strategic planning. The promise of artificial intelligence has been tantalizing for years, but most AI tools have felt more like sophisticated calculators than true productivity game-changers.

Using Agentic AI to Reclaim Time and Transform Client Relationships

The financial advisory industry stands at a fascinating crossroads. While client expectations for personalized service continue to rise, advisors find themselves drowning in administrative tasks, document processing, and repetitive workflows that consume precious hours better spent on relationship building and strategic planning. The promise of artificial intelligence has been tantalizing for years, but most AI tools have felt more like sophisticated calculators than true productivity game-changers.

Using Agentic AI to Reclaim Time and Transform Client Relationships

The financial advisory industry stands at a fascinating crossroads. While client expectations for personalized service continue to rise, advisors find themselves drowning in administrative tasks, document processing, and repetitive workflows that consume precious hours better spent on relationship building and strategic planning. The promise of artificial intelligence has been tantalizing for years, but most AI tools have felt more like sophisticated calculators than true productivity game-changers.

The Five Pillars of Client Retention Using AI

Here's a statistic that should make every advisory firm leader pause: while client retention rates hover around 95% in the first year, they plummet to just 70% over five years. That 25-percentage-point drop isn't gradual decline. It's systematic hemorrhaging, and it's happening in the most critical window for relationship development. Think about the economics here. The "honeymoon period" creates a false sense of security. Advisors celebrate their 95% first-year retention without realizing they're about to lose one in three clients over the next four years. The most dangerous period? Months 12 to 48, when clients are actively assessing whether their advisor truly meets their needs.

The Five Pillars of Client Retention Using AI

Here's a statistic that should make every advisory firm leader pause: while client retention rates hover around 95% in the first year, they plummet to just 70% over five years. That 25-percentage-point drop isn't gradual decline. It's systematic hemorrhaging, and it's happening in the most critical window for relationship development. Think about the economics here. The "honeymoon period" creates a false sense of security. Advisors celebrate their 95% first-year retention without realizing they're about to lose one in three clients over the next four years. The most dangerous period? Months 12 to 48, when clients are actively assessing whether their advisor truly meets their needs.

The Five Pillars of Client Retention Using AI

Here's a statistic that should make every advisory firm leader pause: while client retention rates hover around 95% in the first year, they plummet to just 70% over five years. That 25-percentage-point drop isn't gradual decline. It's systematic hemorrhaging, and it's happening in the most critical window for relationship development. Think about the economics here. The "honeymoon period" creates a false sense of security. Advisors celebrate their 95% first-year retention without realizing they're about to lose one in three clients over the next four years. The most dangerous period? Months 12 to 48, when clients are actively assessing whether their advisor truly meets their needs.

AI for Compliance, Security & Data Management

Download the compliance checklist to evaluate AI tools and vendors

Detailed 8 point checklist. Download from below.

Download the compliance checklist to evaluate AI tools and vendors

Detailed 8 point checklist. Download from below.

Download the compliance checklist to evaluate AI tools and vendors

Detailed 8 point checklist. Download from below.

AI Automation, Compliance and the RIA Time Trap

How Advisory Firms Can Reclaim Two Days a Week Without Breaking Compliance

AI Automation, Compliance and the RIA Time Trap

How Advisory Firms Can Reclaim Two Days a Week Without Breaking Compliance

AI Automation, Compliance and the RIA Time Trap

How Advisory Firms Can Reclaim Two Days a Week Without Breaking Compliance

Data and Compliance for RIAs

Here's a sobering reality check: While global assets under management are projected to reach $100 trillion by 2025, the average RIA is still managing client relationships with the same fragmented, reactive approach they used a decade ago. Spreadsheets for client segmentation. Email threads for compliance tracking. Manual processes for risk monitoring. Post-it notes for follow-ups.

Data and Compliance for RIAs

Here's a sobering reality check: While global assets under management are projected to reach $100 trillion by 2025, the average RIA is still managing client relationships with the same fragmented, reactive approach they used a decade ago. Spreadsheets for client segmentation. Email threads for compliance tracking. Manual processes for risk monitoring. Post-it notes for follow-ups.

Data and Compliance for RIAs

Here's a sobering reality check: While global assets under management are projected to reach $100 trillion by 2025, the average RIA is still managing client relationships with the same fragmented, reactive approach they used a decade ago. Spreadsheets for client segmentation. Email threads for compliance tracking. Manual processes for risk monitoring. Post-it notes for follow-ups.

The Role of AI in Wealth Management Strategy

AI in Wealth Management: Delivering Superior Client Experiences

Client expectations are rising, faster answers, deeper personalization, and always-on service. This article maps where AI delivers the biggest lift: intelligent data ingestion, automated note-taking, streamlined compliance, and proactive client service. You’ll see how RIAs use AI to shorten response times, surface insights from unstructured data, and fortify risk management without adding headcount. The message is pragmatic: AI won’t replace advisors, but advisors who integrate AI into core workflows will outpace peers on client retention and growth. Perfect for firms crafting a client experience strategy that blends human advice with automation.

AI in Wealth Management: Delivering Superior Client Experiences

Client expectations are rising, faster answers, deeper personalization, and always-on service. This article maps where AI delivers the biggest lift: intelligent data ingestion, automated note-taking, streamlined compliance, and proactive client service. You’ll see how RIAs use AI to shorten response times, surface insights from unstructured data, and fortify risk management without adding headcount. The message is pragmatic: AI won’t replace advisors, but advisors who integrate AI into core workflows will outpace peers on client retention and growth. Perfect for firms crafting a client experience strategy that blends human advice with automation.

AI in Wealth Management: Delivering Superior Client Experiences

Client expectations are rising, faster answers, deeper personalization, and always-on service. This article maps where AI delivers the biggest lift: intelligent data ingestion, automated note-taking, streamlined compliance, and proactive client service. You’ll see how RIAs use AI to shorten response times, surface insights from unstructured data, and fortify risk management without adding headcount. The message is pragmatic: AI won’t replace advisors, but advisors who integrate AI into core workflows will outpace peers on client retention and growth. Perfect for firms crafting a client experience strategy that blends human advice with automation.

AI for Financial Advisors: Using AI To Automate, Optimize, and Elevate

Last week, I met a financial advisor who proudly declared he was “fully digital”, yet couldn’t be productive. Naturally, I was curious. Beaming with pride he pulled up his computer screen. He showed us his Excel spreadsheet, a few email templates, and a CRM system that probably remembers when the banks used ledger books and tellers to stamp deposit slips manually. You see, this isn't some isolated incident. Every week, I meet advisors who think having some systems makes them digitally up-to-date. Painful, but also a perfect snapshot of our industry in 2025.

AI for Financial Advisors: Using AI To Automate, Optimize, and Elevate

Last week, I met a financial advisor who proudly declared he was “fully digital”, yet couldn’t be productive. Naturally, I was curious. Beaming with pride he pulled up his computer screen. He showed us his Excel spreadsheet, a few email templates, and a CRM system that probably remembers when the banks used ledger books and tellers to stamp deposit slips manually. You see, this isn't some isolated incident. Every week, I meet advisors who think having some systems makes them digitally up-to-date. Painful, but also a perfect snapshot of our industry in 2025.

AI for Financial Advisors: Using AI To Automate, Optimize, and Elevate

Last week, I met a financial advisor who proudly declared he was “fully digital”, yet couldn’t be productive. Naturally, I was curious. Beaming with pride he pulled up his computer screen. He showed us his Excel spreadsheet, a few email templates, and a CRM system that probably remembers when the banks used ledger books and tellers to stamp deposit slips manually. You see, this isn't some isolated incident. Every week, I meet advisors who think having some systems makes them digitally up-to-date. Painful, but also a perfect snapshot of our industry in 2025.

Financial Planning for the Next Generation

The traditional advice models built around asset management fees and high net worth thresholds are colliding with the realities of an emerging client base. Millennials, and now Gen Z, represent the largest generational wealth transfer in history. Yet many of their expectations for financial advice look markedly different from the generations before them. For advisors, the challenge is not only to understand these differences but to adapt business models and tools to serve this new audience effectively.

Financial Planning for the Next Generation

The traditional advice models built around asset management fees and high net worth thresholds are colliding with the realities of an emerging client base. Millennials, and now Gen Z, represent the largest generational wealth transfer in history. Yet many of their expectations for financial advice look markedly different from the generations before them. For advisors, the challenge is not only to understand these differences but to adapt business models and tools to serve this new audience effectively.

Financial Planning for the Next Generation

The traditional advice models built around asset management fees and high net worth thresholds are colliding with the realities of an emerging client base. Millennials, and now Gen Z, represent the largest generational wealth transfer in history. Yet many of their expectations for financial advice look markedly different from the generations before them. For advisors, the challenge is not only to understand these differences but to adapt business models and tools to serve this new audience effectively.

Tech and the Transformation of Wealth Planning

The economics and client expectations that once rewarded commission and AUM models are changing. Clients want transparent pricing, digital-first experiences, and personalized value. Technology now makes it possible for financial planning firms to serve more clients at lower per-client revenue while protecting margins. This combination is forcing a major rethink of how advisory businesses are priced, operated, and scaled.

Tech and the Transformation of Wealth Planning

The economics and client expectations that once rewarded commission and AUM models are changing. Clients want transparent pricing, digital-first experiences, and personalized value. Technology now makes it possible for financial planning firms to serve more clients at lower per-client revenue while protecting margins. This combination is forcing a major rethink of how advisory businesses are priced, operated, and scaled.

Tech and the Transformation of Wealth Planning

The economics and client expectations that once rewarded commission and AUM models are changing. Clients want transparent pricing, digital-first experiences, and personalized value. Technology now makes it possible for financial planning firms to serve more clients at lower per-client revenue while protecting margins. This combination is forcing a major rethink of how advisory businesses are priced, operated, and scaled.

Why Financial Advice Is More Than Just Money Management

When most people hear the phrase “financial advisor,” their first thought is: someone who manages my investments.

It’s not surprising. Investments are visible, easy to measure, and easy to compare across providers. You can see your returns on a statement, benchmark them against the S&P 500, and even replicate an entire diversified portfolio on your own in a matter of minutes.

But here’s the catch: money management is the commodity. True financial advice is the differentiator.

Why Financial Advice Is More Than Just Money Management

When most people hear the phrase “financial advisor,” their first thought is: someone who manages my investments.

It’s not surprising. Investments are visible, easy to measure, and easy to compare across providers. You can see your returns on a statement, benchmark them against the S&P 500, and even replicate an entire diversified portfolio on your own in a matter of minutes.

But here’s the catch: money management is the commodity. True financial advice is the differentiator.

Why Financial Advice Is More Than Just Money Management

When most people hear the phrase “financial advisor,” their first thought is: someone who manages my investments.

It’s not surprising. Investments are visible, easy to measure, and easy to compare across providers. You can see your returns on a statement, benchmark them against the S&P 500, and even replicate an entire diversified portfolio on your own in a matter of minutes.

But here’s the catch: money management is the commodity. True financial advice is the differentiator.

Wealth Management Opportunity, Challenges and Top Use Cases

Wealth management today finds itself at a pivotal point. An estimated $84 trillion in generational wealth transfer is expected over the next two decades. Yet beneath this surface excitement lie structural headwinds that threaten to stall, or even reverse the momentum. Here's the nuanced reality: advisory firms are facing structural impediments that threaten to limit their ability to capitalize on this opportunity. These challenges aren't merely cyclical bumps - they represent fundamental shifts in the industry's operating environment. To thrive over the next decade financial advisors and RIA's need to adapt fast, scale smartly, and harness new AI tools without burning out their teams or sacrificing client service.

Wealth Management Opportunity, Challenges and Top Use Cases

Wealth management today finds itself at a pivotal point. An estimated $84 trillion in generational wealth transfer is expected over the next two decades. Yet beneath this surface excitement lie structural headwinds that threaten to stall, or even reverse the momentum. Here's the nuanced reality: advisory firms are facing structural impediments that threaten to limit their ability to capitalize on this opportunity. These challenges aren't merely cyclical bumps - they represent fundamental shifts in the industry's operating environment. To thrive over the next decade financial advisors and RIA's need to adapt fast, scale smartly, and harness new AI tools without burning out their teams or sacrificing client service.

Wealth Management Opportunity, Challenges and Top Use Cases

Wealth management today finds itself at a pivotal point. An estimated $84 trillion in generational wealth transfer is expected over the next two decades. Yet beneath this surface excitement lie structural headwinds that threaten to stall, or even reverse the momentum. Here's the nuanced reality: advisory firms are facing structural impediments that threaten to limit their ability to capitalize on this opportunity. These challenges aren't merely cyclical bumps - they represent fundamental shifts in the industry's operating environment. To thrive over the next decade financial advisors and RIA's need to adapt fast, scale smartly, and harness new AI tools without burning out their teams or sacrificing client service.

AI For RIA's And Financial Advisors

What we're experiencing now with artificial intelligence and the wealth management space isn't merely another incremental step - it's a fundamental reimagining of the advisory landscape. On one hand, we’re witnessing unprecedented growth in assets under management (AUM) and a tidal wave of generational wealth transfer; on the other, advisors grapple with razor-thin fees, talent shortages, and an ever-more complex regulatory environment. Against this backdrop, technology - once a back-office afterthought - has become mission-critical. And now, with the rise of generative AI, the promise is not just incremental efficiency gains but wholesale transformation.

AI For RIA's And Financial Advisors

What we're experiencing now with artificial intelligence and the wealth management space isn't merely another incremental step - it's a fundamental reimagining of the advisory landscape. On one hand, we’re witnessing unprecedented growth in assets under management (AUM) and a tidal wave of generational wealth transfer; on the other, advisors grapple with razor-thin fees, talent shortages, and an ever-more complex regulatory environment. Against this backdrop, technology - once a back-office afterthought - has become mission-critical. And now, with the rise of generative AI, the promise is not just incremental efficiency gains but wholesale transformation.

AI For RIA's And Financial Advisors

What we're experiencing now with artificial intelligence and the wealth management space isn't merely another incremental step - it's a fundamental reimagining of the advisory landscape. On one hand, we’re witnessing unprecedented growth in assets under management (AUM) and a tidal wave of generational wealth transfer; on the other, advisors grapple with razor-thin fees, talent shortages, and an ever-more complex regulatory environment. Against this backdrop, technology - once a back-office afterthought - has become mission-critical. And now, with the rise of generative AI, the promise is not just incremental efficiency gains but wholesale transformation.

Beyond the Usual: How RIA Firms Are Reimagining Their Tech Stack for Efficiency and Growth

The financial advisory industry has reached an inflection point where technology choices are no longer just operational decisions, they're strategic advantages that can fundamentally reshape how firms serve clients and scale their practices. With rising client expectations, increased regulatory oversight, and market volatility, advisors are facing a dual mandate: provide deeper value while also operating leaner. While the wealthtech marketplace is flooded with off-the-shelf CRM, meeting notes and financial planning tools, a growing number of forward-thinking practitioners are discovering that the most powerful solutions often lie beyond the traditional wealthtech universe. These advisors aren't just seeking efficiency, they're reimagining what their technology stack could be when freed from conventional constraints.

Beyond the Usual: How RIA Firms Are Reimagining Their Tech Stack for Efficiency and Growth

The financial advisory industry has reached an inflection point where technology choices are no longer just operational decisions, they're strategic advantages that can fundamentally reshape how firms serve clients and scale their practices. With rising client expectations, increased regulatory oversight, and market volatility, advisors are facing a dual mandate: provide deeper value while also operating leaner. While the wealthtech marketplace is flooded with off-the-shelf CRM, meeting notes and financial planning tools, a growing number of forward-thinking practitioners are discovering that the most powerful solutions often lie beyond the traditional wealthtech universe. These advisors aren't just seeking efficiency, they're reimagining what their technology stack could be when freed from conventional constraints.

Beyond the Usual: How RIA Firms Are Reimagining Their Tech Stack for Efficiency and Growth

The financial advisory industry has reached an inflection point where technology choices are no longer just operational decisions, they're strategic advantages that can fundamentally reshape how firms serve clients and scale their practices. With rising client expectations, increased regulatory oversight, and market volatility, advisors are facing a dual mandate: provide deeper value while also operating leaner. While the wealthtech marketplace is flooded with off-the-shelf CRM, meeting notes and financial planning tools, a growing number of forward-thinking practitioners are discovering that the most powerful solutions often lie beyond the traditional wealthtech universe. These advisors aren't just seeking efficiency, they're reimagining what their technology stack could be when freed from conventional constraints.

Three Big Opportunities for Wealth Advisors (and How AI Helps You Capture Them)

AUM expansion, a historic wealth transfer, and private-markets growth are redrawing the advisory map. This piece connects those macro trends to firm-level strategy: where AI delivers leverage (data ingestion, analysis, client prospecting), how to navigate talent shortages and fee pressure, and why an integrated, AI-ready tech stack beats a patchwork of tools. You’ll get crisp context you can use in partner meetings and planning offsites, plus a short list of workflow bets that compound: document automation, predictive outreach, and compliant note systems.

Three Big Opportunities for Wealth Advisors (and How AI Helps You Capture Them)

AUM expansion, a historic wealth transfer, and private-markets growth are redrawing the advisory map. This piece connects those macro trends to firm-level strategy: where AI delivers leverage (data ingestion, analysis, client prospecting), how to navigate talent shortages and fee pressure, and why an integrated, AI-ready tech stack beats a patchwork of tools. You’ll get crisp context you can use in partner meetings and planning offsites, plus a short list of workflow bets that compound: document automation, predictive outreach, and compliant note systems.

Three Big Opportunities for Wealth Advisors (and How AI Helps You Capture Them)

AUM expansion, a historic wealth transfer, and private-markets growth are redrawing the advisory map. This piece connects those macro trends to firm-level strategy: where AI delivers leverage (data ingestion, analysis, client prospecting), how to navigate talent shortages and fee pressure, and why an integrated, AI-ready tech stack beats a patchwork of tools. You’ll get crisp context you can use in partner meetings and planning offsites, plus a short list of workflow bets that compound: document automation, predictive outreach, and compliant note systems.

AI And Technology Guide For The New RIAs: How To Build Your Perfect Tech Stack

Launching an RIA today is less about picking tools and more about architecting a scalable system. This guide walks through core components, CRM, portfolio management, planning, secure document management, and shows how to align them with firm strategy, growth plans, and client experience goals. You’ll learn how vertical AI supercharges the stack with automated data flows, compliant notes, and workflow orchestration. It’s an excellent roadmap for avoiding fragmentation, prioritizing integrations, and sequencing investments so your stack scales as your team grows. Ideal for founders and ops leaders designing a durable, AI-ready infrastructure from day one.

AI And Technology Guide For The New RIAs: How To Build Your Perfect Tech Stack

Launching an RIA today is less about picking tools and more about architecting a scalable system. This guide walks through core components, CRM, portfolio management, planning, secure document management, and shows how to align them with firm strategy, growth plans, and client experience goals. You’ll learn how vertical AI supercharges the stack with automated data flows, compliant notes, and workflow orchestration. It’s an excellent roadmap for avoiding fragmentation, prioritizing integrations, and sequencing investments so your stack scales as your team grows. Ideal for founders and ops leaders designing a durable, AI-ready infrastructure from day one.

AI And Technology Guide For The New RIAs: How To Build Your Perfect Tech Stack

Launching an RIA today is less about picking tools and more about architecting a scalable system. This guide walks through core components, CRM, portfolio management, planning, secure document management, and shows how to align them with firm strategy, growth plans, and client experience goals. You’ll learn how vertical AI supercharges the stack with automated data flows, compliant notes, and workflow orchestration. It’s an excellent roadmap for avoiding fragmentation, prioritizing integrations, and sequencing investments so your stack scales as your team grows. Ideal for founders and ops leaders designing a durable, AI-ready infrastructure from day one.

Advisor Trends, Behavior & Industry Commentary

41 Must-Watch Podcasts for Financial Advisors (and How to Make Them Actionable)

This curated list helps advisors convert podcast listening into measurable practice growth. Instead of passive consumption, it outlines an “active learning” system: pick shows by business goal (prospecting, operations, client experience), take structured notes, implement within 48 hours, and track what actually moves AUM and meetings booked. Highlights span marketing tactics, advisor workflows, and leadership. If you’re building a professional development flywheel, this guide shows how to operationalize insights from industry leaders, turning content into experiments, dashboards, and repeatable wins. Smart, practical, and designed for busy wealth managers who want results, not noise.

41 Must-Watch Podcasts for Financial Advisors (and How to Make Them Actionable)

This curated list helps advisors convert podcast listening into measurable practice growth. Instead of passive consumption, it outlines an “active learning” system: pick shows by business goal (prospecting, operations, client experience), take structured notes, implement within 48 hours, and track what actually moves AUM and meetings booked. Highlights span marketing tactics, advisor workflows, and leadership. If you’re building a professional development flywheel, this guide shows how to operationalize insights from industry leaders, turning content into experiments, dashboards, and repeatable wins. Smart, practical, and designed for busy wealth managers who want results, not noise.

41 Must-Watch Podcasts for Financial Advisors (and How to Make Them Actionable)

This curated list helps advisors convert podcast listening into measurable practice growth. Instead of passive consumption, it outlines an “active learning” system: pick shows by business goal (prospecting, operations, client experience), take structured notes, implement within 48 hours, and track what actually moves AUM and meetings booked. Highlights span marketing tactics, advisor workflows, and leadership. If you’re building a professional development flywheel, this guide shows how to operationalize insights from industry leaders, turning content into experiments, dashboards, and repeatable wins. Smart, practical, and designed for busy wealth managers who want results, not noise.

Advisory 3.0: Tech, Trust, and Tailored Financial Planning

Advisory 3.0 is the next wave for RIAs and financial advisors. This deep guide explains Advisory 1.0 and 2.0, then maps the practical, technology-enabled, advice-first playbook advisors must adopt today. Includes Modern Retirement ideas, advice-only business models, AI note-takers, CRM workflows, and an actionable implementation checklist.

Advisory 3.0: Tech, Trust, and Tailored Financial Planning

Advisory 3.0 is the next wave for RIAs and financial advisors. This deep guide explains Advisory 1.0 and 2.0, then maps the practical, technology-enabled, advice-first playbook advisors must adopt today. Includes Modern Retirement ideas, advice-only business models, AI note-takers, CRM workflows, and an actionable implementation checklist.

Advisory 3.0: Tech, Trust, and Tailored Financial Planning

Advisory 3.0 is the next wave for RIAs and financial advisors. This deep guide explains Advisory 1.0 and 2.0, then maps the practical, technology-enabled, advice-first playbook advisors must adopt today. Includes Modern Retirement ideas, advice-only business models, AI note-takers, CRM workflows, and an actionable implementation checklist.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Allie is not your typical financial advisor. Before stepping into finance, she spent over a decade as a theatre artist, educator, and wellness practitioner, including work in trauma-informed care, meditation, and “Theatre of the Oppressed.” That same philosophy now guides how she supports her clients relationship with money. This conversation explores how emotional intelligence, systems of oppression, creativity, and technology intersect in the world of financial planning. If you’ve ever felt anxious, ashamed, confused, or intimidated by money, this episode explains why and shows a new, compassionate way forward.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Allie is not your typical financial advisor. Before stepping into finance, she spent over a decade as a theatre artist, educator, and wellness practitioner, including work in trauma-informed care, meditation, and “Theatre of the Oppressed.” That same philosophy now guides how she supports her clients relationship with money. This conversation explores how emotional intelligence, systems of oppression, creativity, and technology intersect in the world of financial planning. If you’ve ever felt anxious, ashamed, confused, or intimidated by money, this episode explains why and shows a new, compassionate way forward.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Allie is not your typical financial advisor. Before stepping into finance, she spent over a decade as a theatre artist, educator, and wellness practitioner, including work in trauma-informed care, meditation, and “Theatre of the Oppressed.” That same philosophy now guides how she supports her clients relationship with money. This conversation explores how emotional intelligence, systems of oppression, creativity, and technology intersect in the world of financial planning. If you’ve ever felt anxious, ashamed, confused, or intimidated by money, this episode explains why and shows a new, compassionate way forward.

Systematizing CRMs to Power Lean Tech for Scalable Growth

In this episode, Vineet Mohan sits down with Stephanie Shepherd, a Salesforce consultant whose work sits at the intersection of RIA operations, advisor workflows, and automation. With more than nineteen years in the advisory industry and deep expertise implementing and optimizing Salesforce for RIAs, Stephanie brings a rare mix of operational clarity, tech fluency, and lived advisory experience.

Systematizing CRMs to Power Lean Tech for Scalable Growth

In this episode, Vineet Mohan sits down with Stephanie Shepherd, a Salesforce consultant whose work sits at the intersection of RIA operations, advisor workflows, and automation. With more than nineteen years in the advisory industry and deep expertise implementing and optimizing Salesforce for RIAs, Stephanie brings a rare mix of operational clarity, tech fluency, and lived advisory experience.

Systematizing CRMs to Power Lean Tech for Scalable Growth

In this episode, Vineet Mohan sits down with Stephanie Shepherd, a Salesforce consultant whose work sits at the intersection of RIA operations, advisor workflows, and automation. With more than nineteen years in the advisory industry and deep expertise implementing and optimizing Salesforce for RIAs, Stephanie brings a rare mix of operational clarity, tech fluency, and lived advisory experience.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Financial advisors often view their CRM as a necessary administrative tool, a place to store names, phone numbers, birthdays, and a record of client interactions. But as advisory firms scale, the CRM can (and must) become something much more: a command center for operations, client engagement, and growth.

That’s the transformation CRM strategist Stephanie Dannebaum helps firms achieve. A former advisor herself, she’s spent the last decade helping financial planning firms and RIAs optimize platforms like Wealthbox CRM and Redtail CRM, turning them from static databases into dynamic business systems.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Financial advisors often view their CRM as a necessary administrative tool, a place to store names, phone numbers, birthdays, and a record of client interactions. But as advisory firms scale, the CRM can (and must) become something much more: a command center for operations, client engagement, and growth.

That’s the transformation CRM strategist Stephanie Dannebaum helps firms achieve. A former advisor herself, she’s spent the last decade helping financial planning firms and RIAs optimize platforms like Wealthbox CRM and Redtail CRM, turning them from static databases into dynamic business systems.

Systematizing CRMs to Power Lean Tech for Scalable Growth

Financial advisors often view their CRM as a necessary administrative tool, a place to store names, phone numbers, birthdays, and a record of client interactions. But as advisory firms scale, the CRM can (and must) become something much more: a command center for operations, client engagement, and growth.

That’s the transformation CRM strategist Stephanie Dannebaum helps firms achieve. A former advisor herself, she’s spent the last decade helping financial planning firms and RIAs optimize platforms like Wealthbox CRM and Redtail CRM, turning them from static databases into dynamic business systems.

Democratizing Financial Advice: How AI Levels the Playing Field

We sat down with Zach Stein, CEO and Co-CIO of Carbon Collective, to explore how retirement savings can be reimagined for a world facing accelerating climate change. Zach’s journey is as unique as his vision. From building agricultural technology startups to creating a platform that aligns retirement planning with climate realities, his story offers a compelling roadmap for financial advisors, wealth managers, and mission-driven employers looking to serve a new generation of investors.

Democratizing Financial Advice: How AI Levels the Playing Field

We sat down with Zach Stein, CEO and Co-CIO of Carbon Collective, to explore how retirement savings can be reimagined for a world facing accelerating climate change. Zach’s journey is as unique as his vision. From building agricultural technology startups to creating a platform that aligns retirement planning with climate realities, his story offers a compelling roadmap for financial advisors, wealth managers, and mission-driven employers looking to serve a new generation of investors.

Democratizing Financial Advice: How AI Levels the Playing Field

We sat down with Zach Stein, CEO and Co-CIO of Carbon Collective, to explore how retirement savings can be reimagined for a world facing accelerating climate change. Zach’s journey is as unique as his vision. From building agricultural technology startups to creating a platform that aligns retirement planning with climate realities, his story offers a compelling roadmap for financial advisors, wealth managers, and mission-driven employers looking to serve a new generation of investors.

Democratizing Financial Advice: How AI Levels the Playing Field

This Advisor Ally episode explores how vertical AI is reshaping access to high-quality financial advice, especially for underserved households. You’ll hear practical stories of advisors using AI to compress prep time, turn unstructured data into client-ready insight, and scale personal touches without sacrificing compliance. The discussion hits advisor trends, adoption hurdles, and why governance, not blanket bans, wins the AI debate. If you’re watching the wealthtech wave and wondering what’s signal vs. noise, this is a grounded, advisor-first perspective. Key takeaways include new workflows for note-taking and follow-ups, the mindset shift from “using tools” to “designing systems,” and how AI can elevate, and humanize, client conversations. Great for leaders crafting a forward-looking practice strategy grounded in real outcomes.

Democratizing Financial Advice: How AI Levels the Playing Field

This Advisor Ally episode explores how vertical AI is reshaping access to high-quality financial advice, especially for underserved households. You’ll hear practical stories of advisors using AI to compress prep time, turn unstructured data into client-ready insight, and scale personal touches without sacrificing compliance. The discussion hits advisor trends, adoption hurdles, and why governance, not blanket bans, wins the AI debate. If you’re watching the wealthtech wave and wondering what’s signal vs. noise, this is a grounded, advisor-first perspective. Key takeaways include new workflows for note-taking and follow-ups, the mindset shift from “using tools” to “designing systems,” and how AI can elevate, and humanize, client conversations. Great for leaders crafting a forward-looking practice strategy grounded in real outcomes.

Democratizing Financial Advice: How AI Levels the Playing Field

This Advisor Ally episode explores how vertical AI is reshaping access to high-quality financial advice, especially for underserved households. You’ll hear practical stories of advisors using AI to compress prep time, turn unstructured data into client-ready insight, and scale personal touches without sacrificing compliance. The discussion hits advisor trends, adoption hurdles, and why governance, not blanket bans, wins the AI debate. If you’re watching the wealthtech wave and wondering what’s signal vs. noise, this is a grounded, advisor-first perspective. Key takeaways include new workflows for note-taking and follow-ups, the mindset shift from “using tools” to “designing systems,” and how AI can elevate, and humanize, client conversations. Great for leaders crafting a forward-looking practice strategy grounded in real outcomes.

A Standout Young Advisor’s Journey: Lessons for the Next Generation

This profile distills career tactics from a rising advisor, how to compound skills fast, leverage AI to stay present in meetings, and build trust through consistency. You’ll pick up practical workflows: automated meeting capture, CRM-driven follow-ups, and a 90-day plan to modernize your practice without disruption. The piece underscores a bigger trend: AI isn’t about replacing relationship work; it creates the time to do it better. If you lead an emerging team or mentor junior talent, share this as a playbook for building momentum, balancing tech with touch, and winning in an increasingly data-rich, client-first market.

A Standout Young Advisor’s Journey: Lessons for the Next Generation

This profile distills career tactics from a rising advisor, how to compound skills fast, leverage AI to stay present in meetings, and build trust through consistency. You’ll pick up practical workflows: automated meeting capture, CRM-driven follow-ups, and a 90-day plan to modernize your practice without disruption. The piece underscores a bigger trend: AI isn’t about replacing relationship work; it creates the time to do it better. If you lead an emerging team or mentor junior talent, share this as a playbook for building momentum, balancing tech with touch, and winning in an increasingly data-rich, client-first market.

A Standout Young Advisor’s Journey: Lessons for the Next Generation

This profile distills career tactics from a rising advisor, how to compound skills fast, leverage AI to stay present in meetings, and build trust through consistency. You’ll pick up practical workflows: automated meeting capture, CRM-driven follow-ups, and a 90-day plan to modernize your practice without disruption. The piece underscores a bigger trend: AI isn’t about replacing relationship work; it creates the time to do it better. If you lead an emerging team or mentor junior talent, share this as a playbook for building momentum, balancing tech with touch, and winning in an increasingly data-rich, client-first market.

Building an $800M Advisory Firm

Summary:

This long-form profile tracks Jack Firestone’s extraordinary career pivot from orchestra management to building an $800M RIA. The story highlights resilience, mentorship, and the shift toward holistic financial planning. Advisors will learn how career adaptability, mentorship from industry leaders, and relentless client focus build enduring firms. It underscores an industry truth: tomorrow’s biggest firms won’t just be built on investment prowess but on strategy, adaptability, and cultural alignment. For rising advisors and firm owners, this narrative provides both inspiration and tactical lessons, showing how diverse backgrounds, client-centric design, and technology adoption can accelerate firm growth.

Building an $800M Advisory Firm

Summary:

This long-form profile tracks Jack Firestone’s extraordinary career pivot from orchestra management to building an $800M RIA. The story highlights resilience, mentorship, and the shift toward holistic financial planning. Advisors will learn how career adaptability, mentorship from industry leaders, and relentless client focus build enduring firms. It underscores an industry truth: tomorrow’s biggest firms won’t just be built on investment prowess but on strategy, adaptability, and cultural alignment. For rising advisors and firm owners, this narrative provides both inspiration and tactical lessons, showing how diverse backgrounds, client-centric design, and technology adoption can accelerate firm growth.

Building an $800M Advisory Firm

Summary:

This long-form profile tracks Jack Firestone’s extraordinary career pivot from orchestra management to building an $800M RIA. The story highlights resilience, mentorship, and the shift toward holistic financial planning. Advisors will learn how career adaptability, mentorship from industry leaders, and relentless client focus build enduring firms. It underscores an industry truth: tomorrow’s biggest firms won’t just be built on investment prowess but on strategy, adaptability, and cultural alignment. For rising advisors and firm owners, this narrative provides both inspiration and tactical lessons, showing how diverse backgrounds, client-centric design, and technology adoption can accelerate firm growth.

The Journalist Every Financial Advisor Reads

In this episode of Advisor Ally, we've with us Oisín Breen, an award-winning Irish journalist, poet, systems thinker, and academic who's spent nearly a decade dissecting the Registered Investment Advisor (RIA) space for RIABiz. From his unusual path (horse-riding in the Irish countryside, FX analyst gigs, and late-blooming academia) to his penetrating critiques of wealth management, media narratives, and artificial intelligence, Breen offers a rare, multidimensional perspective. He’s not just watching the RIA world evolve: he’s documenting its soul, its cycles, and its contradictions.

The Journalist Every Financial Advisor Reads

In this episode of Advisor Ally, we've with us Oisín Breen, an award-winning Irish journalist, poet, systems thinker, and academic who's spent nearly a decade dissecting the Registered Investment Advisor (RIA) space for RIABiz. From his unusual path (horse-riding in the Irish countryside, FX analyst gigs, and late-blooming academia) to his penetrating critiques of wealth management, media narratives, and artificial intelligence, Breen offers a rare, multidimensional perspective. He’s not just watching the RIA world evolve: he’s documenting its soul, its cycles, and its contradictions.

The Journalist Every Financial Advisor Reads

In this episode of Advisor Ally, we've with us Oisín Breen, an award-winning Irish journalist, poet, systems thinker, and academic who's spent nearly a decade dissecting the Registered Investment Advisor (RIA) space for RIABiz. From his unusual path (horse-riding in the Irish countryside, FX analyst gigs, and late-blooming academia) to his penetrating critiques of wealth management, media narratives, and artificial intelligence, Breen offers a rare, multidimensional perspective. He’s not just watching the RIA world evolve: he’s documenting its soul, its cycles, and its contradictions.

The Data Gap In Wealth Management

In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people. In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people.

The Data Gap In Wealth Management

In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people. In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people.

The Data Gap In Wealth Management

In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people. In the wealth management space, advice is everywhere, but understanding is rare. Most advisory platforms today are powered by backward-looking data: portfolio balances, transactions, and risk scores. These inputs make sense to systems, but not to people.

How 15 Years of Bull Market Euphoria Has Created a Generation of Overconfident Investors

Why the current market environment may be setting up investors for unprecedented losses when volatility finally returns. After 15 years of what can only be described as an unprecedented bull market run with historically low volatility, we've created a generation of investors who have never experienced a true market cycle, and this disconnect between perception and reality may be setting the stage for significant wealth destruction when market conditions inevitably normalize.

How 15 Years of Bull Market Euphoria Has Created a Generation of Overconfident Investors

Why the current market environment may be setting up investors for unprecedented losses when volatility finally returns. After 15 years of what can only be described as an unprecedented bull market run with historically low volatility, we've created a generation of investors who have never experienced a true market cycle, and this disconnect between perception and reality may be setting the stage for significant wealth destruction when market conditions inevitably normalize.

How 15 Years of Bull Market Euphoria Has Created a Generation of Overconfident Investors

Why the current market environment may be setting up investors for unprecedented losses when volatility finally returns. After 15 years of what can only be described as an unprecedented bull market run with historically low volatility, we've created a generation of investors who have never experienced a true market cycle, and this disconnect between perception and reality may be setting the stage for significant wealth destruction when market conditions inevitably normalize.

From Gold Mines To Wealth Management

Picture this: You're rappelling from a helicopter in the jungles of Vietnam, dodging typhoons while searching for gold deposits, then getting chased by bears through the Canadian wilderness. For most people, this sounds like an adventure movie plot. For Jeff Dunn-Bernstein, founder of QE Wealth Management in Portland, Oregon, it was just another day at the office. This isn't your typical "how I became a financial advisor" story. But then again, Dunn-Bernstein's approach to wealth management isn't typical either. His journey from literal gold mining to helping high-net-worth clients mine value from their real estate holdings offers profound lessons about innovation, client service, and the future of advisory practices.

From Gold Mines To Wealth Management

Picture this: You're rappelling from a helicopter in the jungles of Vietnam, dodging typhoons while searching for gold deposits, then getting chased by bears through the Canadian wilderness. For most people, this sounds like an adventure movie plot. For Jeff Dunn-Bernstein, founder of QE Wealth Management in Portland, Oregon, it was just another day at the office. This isn't your typical "how I became a financial advisor" story. But then again, Dunn-Bernstein's approach to wealth management isn't typical either. His journey from literal gold mining to helping high-net-worth clients mine value from their real estate holdings offers profound lessons about innovation, client service, and the future of advisory practices.

From Gold Mines To Wealth Management

Picture this: You're rappelling from a helicopter in the jungles of Vietnam, dodging typhoons while searching for gold deposits, then getting chased by bears through the Canadian wilderness. For most people, this sounds like an adventure movie plot. For Jeff Dunn-Bernstein, founder of QE Wealth Management in Portland, Oregon, it was just another day at the office. This isn't your typical "how I became a financial advisor" story. But then again, Dunn-Bernstein's approach to wealth management isn't typical either. His journey from literal gold mining to helping high-net-worth clients mine value from their real estate holdings offers profound lessons about innovation, client service, and the future of advisory practices.

From IIT Bombay To Wall Street To Starting an RIA

Rarely, do you find any financial advisor who started their careers writing code at Microsoft or building algorithmic trading systems at hedge funds. But for Sukesh Pai, this unconventional background has become his greatest asset in serving a uniquely demanding clientele: high-net-worth engineers and technology professionals. After nearly a decade at Microsoft, where he progressed from Software Design Engineer to Program Manager, Pai made his first pivot into finance, joining Morgan Stanley as a Senior Manager. This move provided crucial exposure to institutional finance and capital markets. From there, he spent over five years at QMS Capital Management, a quantitative hedge fund, where he developed sophisticated investment strategies and honed his skills in algorithmic trading.

From IIT Bombay To Wall Street To Starting an RIA

Rarely, do you find any financial advisor who started their careers writing code at Microsoft or building algorithmic trading systems at hedge funds. But for Sukesh Pai, this unconventional background has become his greatest asset in serving a uniquely demanding clientele: high-net-worth engineers and technology professionals. After nearly a decade at Microsoft, where he progressed from Software Design Engineer to Program Manager, Pai made his first pivot into finance, joining Morgan Stanley as a Senior Manager. This move provided crucial exposure to institutional finance and capital markets. From there, he spent over five years at QMS Capital Management, a quantitative hedge fund, where he developed sophisticated investment strategies and honed his skills in algorithmic trading.

From IIT Bombay To Wall Street To Starting an RIA

Rarely, do you find any financial advisor who started their careers writing code at Microsoft or building algorithmic trading systems at hedge funds. But for Sukesh Pai, this unconventional background has become his greatest asset in serving a uniquely demanding clientele: high-net-worth engineers and technology professionals. After nearly a decade at Microsoft, where he progressed from Software Design Engineer to Program Manager, Pai made his first pivot into finance, joining Morgan Stanley as a Senior Manager. This move provided crucial exposure to institutional finance and capital markets. From there, he spent over five years at QMS Capital Management, a quantitative hedge fund, where he developed sophisticated investment strategies and honed his skills in algorithmic trading.

The Evolving Role Of Financial Advisors In The Age Of AI

It's rare to find a voice that blends the experiential wisdom of the past with an unapologetically forward-looking vision. Steve's career path from clinical pharmacy to becoming a flat-fee financial planner with a tech-forward advisory model offers a compelling case study in how the financial advice profession is both evolving and being redefined from within. Steve's journey didn't begin in finance. It began in pharmacy, an industry with its own set of regulatory rigors, fiduciary responsibilities, and client-centric decision-making. That experience, far from being irrelevant, laid the foundation for his uniquely empathetic and consultative approach to financial advice.

The Evolving Role Of Financial Advisors In The Age Of AI

It's rare to find a voice that blends the experiential wisdom of the past with an unapologetically forward-looking vision. Steve's career path from clinical pharmacy to becoming a flat-fee financial planner with a tech-forward advisory model offers a compelling case study in how the financial advice profession is both evolving and being redefined from within. Steve's journey didn't begin in finance. It began in pharmacy, an industry with its own set of regulatory rigors, fiduciary responsibilities, and client-centric decision-making. That experience, far from being irrelevant, laid the foundation for his uniquely empathetic and consultative approach to financial advice.

The Evolving Role Of Financial Advisors In The Age Of AI

It's rare to find a voice that blends the experiential wisdom of the past with an unapologetically forward-looking vision. Steve's career path from clinical pharmacy to becoming a flat-fee financial planner with a tech-forward advisory model offers a compelling case study in how the financial advice profession is both evolving and being redefined from within. Steve's journey didn't begin in finance. It began in pharmacy, an industry with its own set of regulatory rigors, fiduciary responsibilities, and client-centric decision-making. That experience, far from being irrelevant, laid the foundation for his uniquely empathetic and consultative approach to financial advice.

Transforming Wealth Management Through Vertical AI: The Story Behind FastTrackr AI

This explains why the next leap in wealthtech isn’t another point solution, it’s vertical AI embedded across the advisory lifecycle. You’ll learn how purpose-built models and workflows unlock operating leverage: automating back-office tasks (billing, compliance, reconciliation), accelerating onboarding, and elevating planning conversations. The post covers adoption barriers (ROI visibility, integration complexity) and shows how mature, cloud-native platforms overcome them. For firm owners, it reframes AI from “tool” to “operating model,” with examples of where to start and what metrics to monitor (time-to-onboard, prep hours saved, net revenue per employee).

Transforming Wealth Management Through Vertical AI: The Story Behind FastTrackr AI

This explains why the next leap in wealthtech isn’t another point solution, it’s vertical AI embedded across the advisory lifecycle. You’ll learn how purpose-built models and workflows unlock operating leverage: automating back-office tasks (billing, compliance, reconciliation), accelerating onboarding, and elevating planning conversations. The post covers adoption barriers (ROI visibility, integration complexity) and shows how mature, cloud-native platforms overcome them. For firm owners, it reframes AI from “tool” to “operating model,” with examples of where to start and what metrics to monitor (time-to-onboard, prep hours saved, net revenue per employee).

Transforming Wealth Management Through Vertical AI: The Story Behind FastTrackr AI

This explains why the next leap in wealthtech isn’t another point solution, it’s vertical AI embedded across the advisory lifecycle. You’ll learn how purpose-built models and workflows unlock operating leverage: automating back-office tasks (billing, compliance, reconciliation), accelerating onboarding, and elevating planning conversations. The post covers adoption barriers (ROI visibility, integration complexity) and shows how mature, cloud-native platforms overcome them. For firm owners, it reframes AI from “tool” to “operating model,” with examples of where to start and what metrics to monitor (time-to-onboard, prep hours saved, net revenue per employee).

FastTrackr AI In Action

FastTrackr AI Achieves SOC 2 Type II Certification: A Major Milestone in Security & Trust

Security and compliance are non-negotiable in wealth management. This announcement explains FastTrackr AI’s SOC 2 Type II certification, what it covers, why it matters for RIAs, and how it protects client data across core workflows like document processing, client notes, and CRM sync. You’ll learn how encryption, access controls, and audit trails safeguard sensitive information while enabling automation at scale. For firms evaluating AI vendors, the post provides tangible proof points for due diligence and a blueprint for risk management in an AI-enabled stack. It’s a concise guide you can reference when stakeholders ask, “Is this compliant, and future-proof?”

FastTrackr AI Achieves SOC 2 Type II Certification: A Major Milestone in Security & Trust

Security and compliance are non-negotiable in wealth management. This announcement explains FastTrackr AI’s SOC 2 Type II certification, what it covers, why it matters for RIAs, and how it protects client data across core workflows like document processing, client notes, and CRM sync. You’ll learn how encryption, access controls, and audit trails safeguard sensitive information while enabling automation at scale. For firms evaluating AI vendors, the post provides tangible proof points for due diligence and a blueprint for risk management in an AI-enabled stack. It’s a concise guide you can reference when stakeholders ask, “Is this compliant, and future-proof?”

FastTrackr AI Achieves SOC 2 Type II Certification: A Major Milestone in Security & Trust

Security and compliance are non-negotiable in wealth management. This announcement explains FastTrackr AI’s SOC 2 Type II certification, what it covers, why it matters for RIAs, and how it protects client data across core workflows like document processing, client notes, and CRM sync. You’ll learn how encryption, access controls, and audit trails safeguard sensitive information while enabling automation at scale. For firms evaluating AI vendors, the post provides tangible proof points for due diligence and a blueprint for risk management in an AI-enabled stack. It’s a concise guide you can reference when stakeholders ask, “Is this compliant, and future-proof?”

FastTrackr AI At Wealth Management Edge

This event recap captures the buzz from Wealth Management EDGE, where AI dominated every panel. The article outlines practical use cases beyond note-taking, client onboarding, document-driven recommendations, smart email templating, and shares real advisor stories of time saved and improved client focus. Importantly, it reframes AI as a tool to enhance presence, reduce burnout, and elevate client outcomes. Key takeaways include governance over blind adoption, security as table stakes, and clean data as the hidden goldmine. Advisors are reminded that AI is not the end goal, better advice is. If your firm is wrestling with “when and how” to adopt AI, this piece delivers clarity: start small, govern usage, and scale workflows that move the needle.

FastTrackr AI At Wealth Management Edge

This event recap captures the buzz from Wealth Management EDGE, where AI dominated every panel. The article outlines practical use cases beyond note-taking, client onboarding, document-driven recommendations, smart email templating, and shares real advisor stories of time saved and improved client focus. Importantly, it reframes AI as a tool to enhance presence, reduce burnout, and elevate client outcomes. Key takeaways include governance over blind adoption, security as table stakes, and clean data as the hidden goldmine. Advisors are reminded that AI is not the end goal, better advice is. If your firm is wrestling with “when and how” to adopt AI, this piece delivers clarity: start small, govern usage, and scale workflows that move the needle.

FastTrackr AI At Wealth Management Edge

This event recap captures the buzz from Wealth Management EDGE, where AI dominated every panel. The article outlines practical use cases beyond note-taking, client onboarding, document-driven recommendations, smart email templating, and shares real advisor stories of time saved and improved client focus. Importantly, it reframes AI as a tool to enhance presence, reduce burnout, and elevate client outcomes. Key takeaways include governance over blind adoption, security as table stakes, and clean data as the hidden goldmine. Advisors are reminded that AI is not the end goal, better advice is. If your firm is wrestling with “when and how” to adopt AI, this piece delivers clarity: start small, govern usage, and scale workflows that move the needle.

Ready to Automate Your Practice?

FastTrackr.AI helps financial advisors automate meeting notes, document processing, CRM updates, and compliance: all from a single secure platform built for wealth professionals.